Completing the oregon business identification number file is a breeze with this PDF editor. Try out the following actions to get the document ready without delay.

Step 1: On the webpage, press the orange "Get form now" button.

Step 2: So you will be on your file edit page. It's possible to add, alter, highlight, check, cross, insert or remove areas or words.

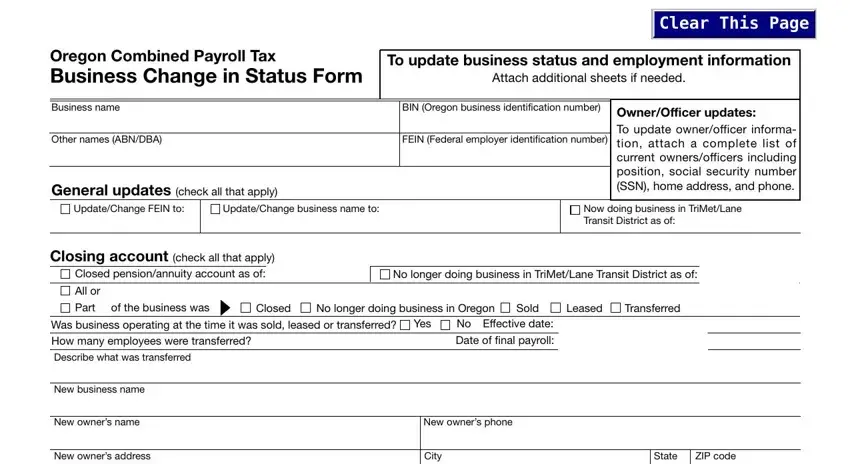

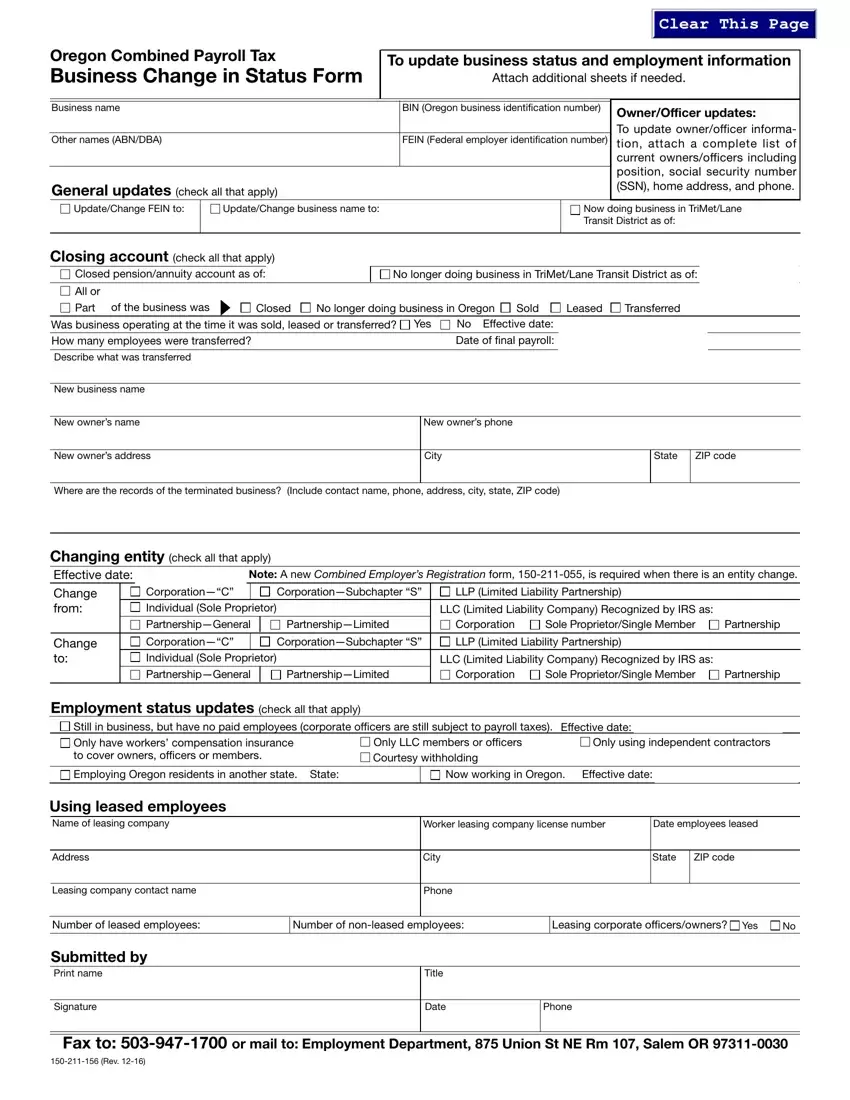

Create the oregon business identification number PDF and provide the details for each area:

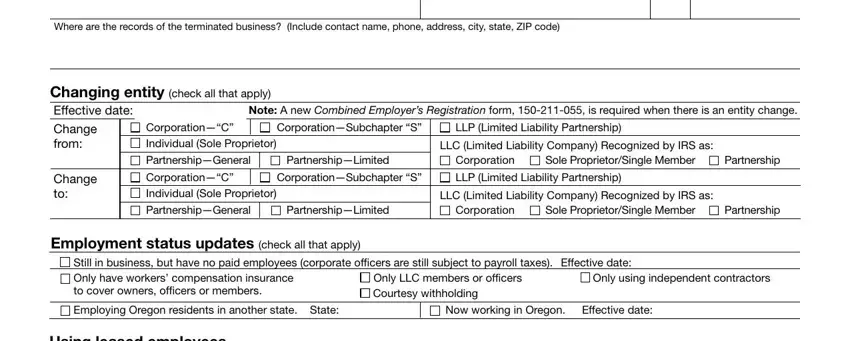

You should write down the required information in the Where are the records of the, Changing entity check all that, Corporation C Individual Sole, Note A new Combined Employers, CorporationSubchapter S, LLP Limited Liability Partnership, LLC Limited Liability Company, Partnership General, PartnershipLimited, Corporation, Sole ProprietorSingle Member, Partnership, Change to, Corporation C Individual Sole, and CorporationSubchapter S area.

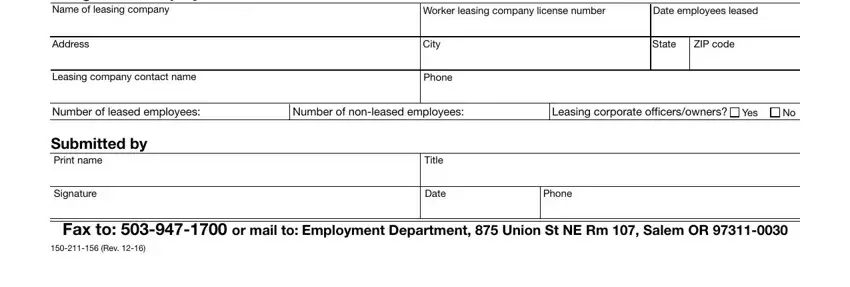

It's important to record particular data inside the section Using leased employees Name of, Address, Leasing company contact name, Worker leasing company license, Date employees leased, City, Phone, State, ZIP code, Number of leased employees, Number of nonleased employees, Leasing corporate officersowners, Yes, Submitted by Print name, and Signature.

Step 3: Hit the Done button to save your file. So now it is obtainable for transfer to your electronic device.

Step 4: Ensure that you remain away from potential complications by producing minimally 2 duplicates of the file.

Still in business, but have no paid employees (corporate officers are still subject to payroll taxes). Effective date:

Still in business, but have no paid employees (corporate officers are still subject to payroll taxes). Effective date: